Stablecoins are arguably the most important use case for DeFi, underpinning critical activities across the sector. Privacy will help accelerate stablecoin use. However, recent legislation, while providing a strong tailwind to stablecoin adoption, requires strict AML/CFT (Anti-Money Laundering and Countering the Financing of Terrorism) compliance. Soda Labs’ technology offers the ideal solution to meet both demands.

Stablecoins have emerged as one of the most important and widespread use cases for DeFi. They are so embedded in the blockchain sector that their significance as a technology is often underestimated – despite the fact that they now represent over $250 billion in crypto value, with transfer volumes topping $27 trillion in 2024.

Stablecoins are an on-chain representation of fiat money (i.e., tokenized fiat). They are used for storing value, payments and remittance, trading, and as collateral for DeFi activities. They are a “force multiplier” for Web3: without them, the blockchain sector would be far smaller and far less impactful than it is. Recent legislation has underscored this, offering clarity but making greater compliance demands on users and issuers.

As tokens that are systemically important to the blockchain world, stablecoins are prime candidates for privacy solutions, but the need to maintain compliance complicates these efforts. Soda Labs has been pioneering a flexible, efficient approach that will enable programmable and compliant privacy for any stablecoin or transaction type.

The Current State Of Stablecoin Privacy

Crypto users have always been sensitive to privacy. Many of Bitcoin’s earliest adopters were libertarians who valued it as a tool of financial freedom – though they initially underestimated the transparency of the blockchain.

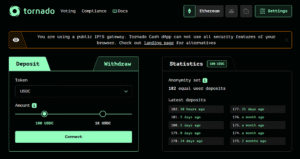

However, there are relatively few solutions for maintaining privacy on Ethereum, even for basic transactions like stablecoin payments. Perhaps the leading platform is Tornado Cash. This decentralized protocol allows users to deposit tokens into a pool, mixing them with funds from other users. The depositor can later withdraw them to a different address (after a delay, and in multiple transactions to obscure the amount) using a Zero-Knowledge proof to demonstrate ownership, without betraying any link to the original deposit address.

Tornado Cash is a controversial solution that was sanctioned in 2022 by the US Treasury Department for its role in facilitating money laundering. Since its launch in 2019, Tornado Cash has processed at least $7 billion in crypto tokens, with Chainalysis estimating around 30% of this was tied to illicit actors. North Korea’s state-sponsored Lazarus Group, for example, is known to be one of the largest users of Tornado Cash, using the platform to anonymize hundreds of millions of dollars.

While sanctions have now been lifted, Tornado Cash remains controversial. Moreover, research suggests that the privacy it offers may be limited, since its anonymity set may be attacked via wallet fingerprints, “quasi-identifiers” (use patterns), and address clustering. It also supports only the most basic form of privacy: simple and limited token transfers.

Programmable, Compliant Privacy With Garbled Circuits

Soda Labs’ garbled circuits-based MPC provides a far more fast, efficient, and flexible solution for private transactions. Unlike Tornado Cash, it supports transactions of all kinds, including DeFi operations. It also enables a flexible degree of compliance, allowing users to optionally provide information to compliance services to facilitate auditing – AML, Travel Rule (TR), accounting, proof of reserves, and so on.

As we have explored in a previous blog post, garbled circuits offer a unique combination of features that sets them apart from other approaches to privacy:

- Decentralization – providing robust availability and avoiding single points of failures (unlike TEEs)

- Versatility, enabling computation on shared state (unlike ZK proofs)

- Efficiency and low storage and bandwidth overheads (unlike FHE)

- Opt-in compliance and auditability (unlike most mixers)

Garbled circuits represent the most promising solution to privacy currently available in the Web3 space.

As regulation around crypto and stablecoins becomes clearer, it is more important than ever to build effective and compliant privacy solutions.

“Crypto Week”: Regulatory Clarity And Stablecoin Adoption

Stablecoin regulation has gained pace in recent months, with a number of key pieces of legislation being passed or currently in process. The week of 14-18 July (dubbed “Crypto Week” in Congress), saw three major pieces of legislation progress significantly.

The GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins Act of 2025) establishes a federal regulatory framework for payment stablecoins, defining them as digital assets pegged to a fixed monetary value (like the US dollar) and used for payment or settlement. The GENIUS Act requires full reserve backing with liquid assets – typically dollars or short-term Treasuries – monthly audits, and compliance with anti-money laundering (AML) regulations. The Act was signed into law on July 18.

The House of Representatives passed the Digital Asset Market CLARITY Act, which now goes to the Senate. The CLARITY Act establishes a regulatory framework for digital commodities, defined by the bill as digital assets that rely upon a blockchain for their value. It explicitly defines “permitted payment stablecoins” as an asset class distinct from securities and commodities, reducing uncertainty about their regulatory status. The Act also underscores the point that “Digital commodity exchanges, brokers, and dealers are subject to the Bank Secrecy Act for anti-money laundering and related purposes.”

Lastly, the Anti‑CBDC Surveillance State Act was advanced in the House. The Act aims to prohibit the Federal Reserve from issuing, testing, or developing a central bank digital currency (CBDC) without explicit Congressional approval, and protects open, permissionless, and private dollar-denominated currencies (i.e. certain stablecoins).

All of this indicates a strong preference for stablecoins over CBDCs. As US Treasury Secretary Scott Bessent has explained, there are further advantages to this approach for the US: Stablecoin regulation will drive demand for Treasuries, reinforcing the dollar’s dominance.

Balancing Privacy With Compliance

Evolving US regulation places stablecoin adoption at a watershed. Privacy will offer greater safety for users and businesses, but can only exist within strict regulatory boundaries. Non-compliant platforms risk being cut off from US markets.

For example, the GENIUS Act requires stablecoin issuers to comply with AML and CFT regulations under the Bank Secrecy Act (BSA). Issuers must implement KYC processes to verify user identities and report suspicious transactions to the Financial Crimes Enforcement Network (FinCEN).

Similarly, the CLARITY Act requires stablecoin issuers to adhere to AML and KYC regulations, aligning with the BSA. This includes verifying customer identities and reporting suspicious activities to combat money laundering and terrorist financing. Permitted Payment Stablecoin Issuers (PPSIs) must monitor transactions to detect and report illegal activities.

While privacy is an important step for users and businesses, then, it must not interfere with AML/CFT. Stablecoin issuers will likely avoid integrating privacy technologies that prevent KYC or transaction monitoring, as non-compliance could lead to regulatory penalties.

The ideal solution is one that shields transactions from malicious parties – MEV bots, phishing, business competitors, and so on – but allows for opt-in compliance when necessary.

There will be a clear divide between legitimate and unacceptable privacy solutions. Users and issuers who employ non-compliant privacy tech risk being flagged by exchanges or issuers, leading to account freezes, further investigation, and potentially serious consequences such as OFAC sanctions.

Soda Labs’ garbled circuits-based MPC offers a powerful but streamlined way to provide users, issuers, and regulators with the tools they need to stay safe but to meet their legal obligations.

Follow Us!

To find out more about Soda Labs’ work on garbled circuits, explore our documentation, join the gcEVM Vanguards Telegram group, or stay up to date with the latest developments by following the project on X.